It’s that time of year again — dues billing is here. In addition to setting up new dues charge codes, it is necessary to create new charge codes for your various contributions. Setting up a charge code for contributions requires just a few simple steps.

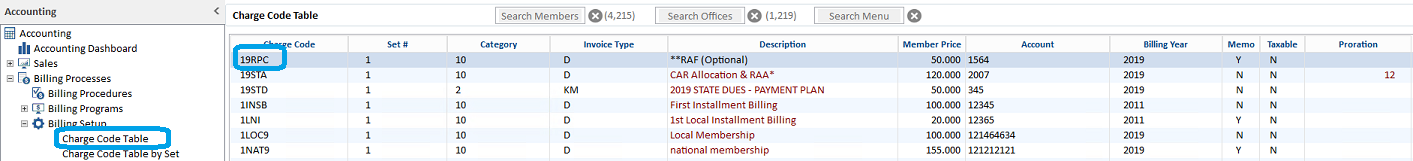

There are various ways to add a charge code, including the Charge Code Table, Charge Code Table by Set, or using the Search Menu field type in either menu.

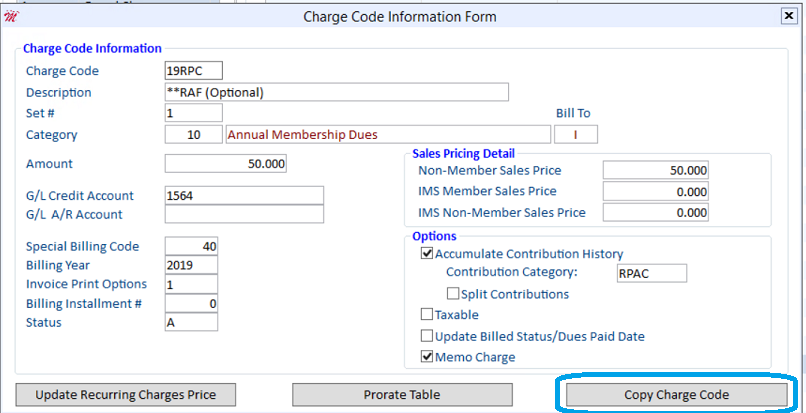

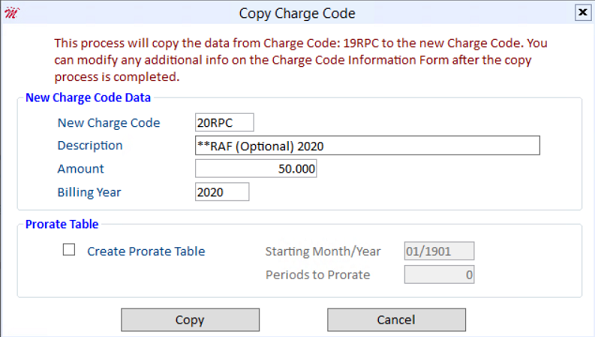

Locate last year’s Charge Code. Press “F5” to zoom and open the Charge Code Information Form for last year’s charge code. You can use the Copy Charge Code feature if you have an existing charge code from the previous year.

If you don’t have any, press “Ctrl+E” to open a blank Charge Code Information Form.

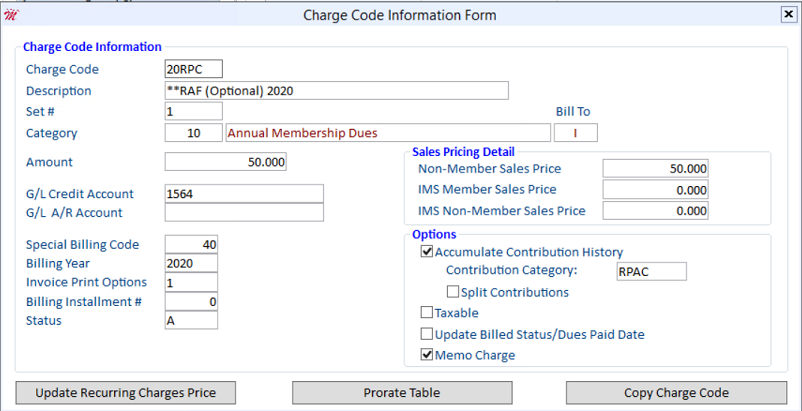

Once the charge code has been created, it will open a new Charge Code Information Form for you to verify the information.

When creating a new contribution charge code, you will need to pay particular attention to the following fields in the Charge Code Information Form.

Billing Year - Set the billing year to the year for which the charge code applies. If the Billing Year field is set to 2020 and payments are received in 2019, the contribution will be recognized for 2020. The Billing Year field is also necessary to run accurate contribution reports.

Accumulate Contribution History - Check this option so the software will update information in your member’s contribution history. The update will occur when payment has been received for this charge code and a Member History Update is run.

Contribution Category - The code that identifies where to direct money received as a contribution.

Split Contributions - If checked, then contributions using the charge code will be split according to the percentages in the Contribution Percentage Table. (This option is primarily used by state associations.)

Memo Charge - Selecting this option indicates that this charge code is a voluntary charge. The charge code will appear as a memo charge on a dues-related invoice but will not be added to your accounts receivable. (Statements can be set up to include memo charges in the Statement/Invoice Set up Form by selecting Print Memo Charges.)

Once your contribution charge codes are correctly set up, you can include them in your annual dues billing. For more information on dues billing, please see our "Billing Procedures" article in the Magic Resource